DUDE, WHERE’S MY DISCOUNT?*

For the first 2 consecutive monthly policies, you will receive 10% off your base premium, and from your 3rd month, your Policy Score will determine any discount after that!

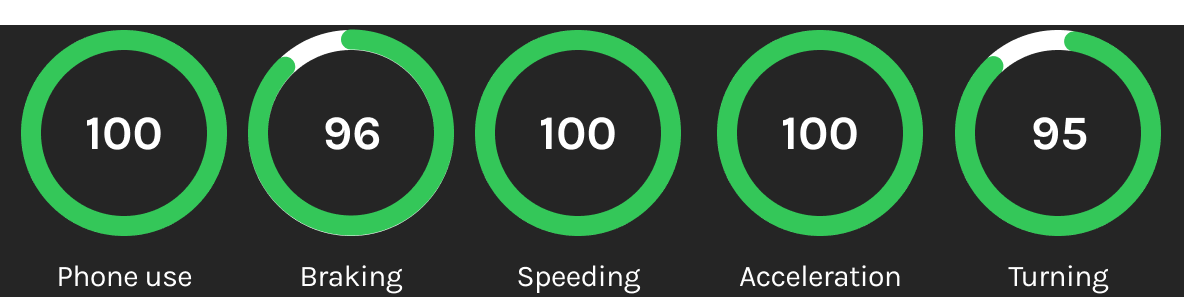

Score 95 or higher to receive a discount of 15% on your base premium.

Score between 90-94 to receive a 10% discount on your base premium.

Score between 85-89 to receive a 5% discount on your base premium.